Prices at the pump remain on track to keep falling in the United States despite the Israel-Hamas war, according to energy industry analysts.

After Hamas’ surprise attack over the weekend, global crude oil jumped to more than $87 a barrel by Monday, from below $83 late last week — roughly a 5% increase. Prices have since retreated, clocking in at $83.62 Wednesday morning.

But Israel and its immediate neighbors aren’t major energy producers, so as long as the conflict doesn’t expand geographically, seasonal trends should continue much as they have for the last few weeks, said Tom Kloza, global head of energy analysis at the Oil Price Information Service.

“On balance, we’re looking at gasoline prices dropping in all 50 states,” he said.

A gallon of regular gas cost $3.66 on average in the U.S. as of Wednesday, according to AAA, down from $3.83 a month ago. Prices at gas stations are falling as Americans wrap up their summer travel and as refineries switch to their winter fuel blend, which is cheaper and easier to produce.

In a note Monday, GasBuddy analyst Patrick De Haan described the initial spike in crude oil prices as a temporary “knee-jerk reaction,” adding that he sees a “very very low risk” of U.S. gas prices rising.

However, Kloza warned, “If you wake up and the theater of war has been expanded to Iran, that changes the calculus.” Tehran has long funded the military wing of Hamas, and U.S. officials are currently investigating whether Hamas fighters received any advance training from Iran’s Islamic Revolutionary Guard Corps.

The winter fuel mix is rolling out at a pace that should allow gas prices to continue falling through the next few weeks, Kloza said, estimating that prices at the pump could drop by as much as 2 cents a gallon each day. That would leave a gallon of regular costing an average $3.25 by Halloween.

The conflict has already affected the operations of producers of other types of energy, including natural gas.

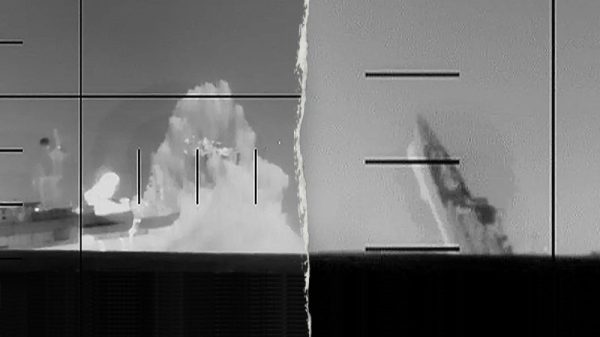

Israeli officials this week ordered the shutdown of the Tamar offshore gas platform, a major Chevron-operated facility off the coast of Gaza. But analysts so far don’t foresee broader disruptions in global supplies, and natural gas prices have been dropping as well.

Most U.S. households are set to spend less to heat their homes this winter, the Energy Information Administration said Wednesday in its latest seasonal forecast, in part because this winter is expected to be warmer than last. The EIA projected the biggest price drops in natural gas costs — with consumer bills for the fuel set to shrink by 21% on average.

Still, crude oil prices on international commodities markets have been volatile lately as traders weighed the violence in the Middle East. That’s partly due to potential uncertainty around shipping routes through which oil produced elsewhere in the region gets to markets around the world.

“A wider conflict including Iran may impact the oil trade through the Strait of Hormuz, a channel Iran has previously threatened to shut,” Deutsche Bank analysts wrote on Tuesday.

Five of the top 10 largest oil producers — Kuwait, Saudi Arabia, Iran, Iraq and the United Arab Emirates — use that waterway, which connects the Persian Gulf to the Arabian Sea, to move about a fifth of the world’s crude oil supply, according EIA data.

But even if Iran were to choke off exports through the strait, the U.S. would have the capacity to lean on its own domestic production, analysts said. U.S. crude oil exports reached a record high in the first half of 2023, extending America’s lead as the largest oil producer in the world, a title it claimed in 2018.

“Oil hates turmoil,” De Haan said in his note, “but if the violence does not spill over into other areas, it should not worsen.”