NEW YORK — Donald Trump this month was ordered by a New York Supreme Court justice to pay a penalty of $354,868,768, plus interest that continues to accrue, because the former president and his company were found to have used false financial statements that deceived banks and insurance companies.

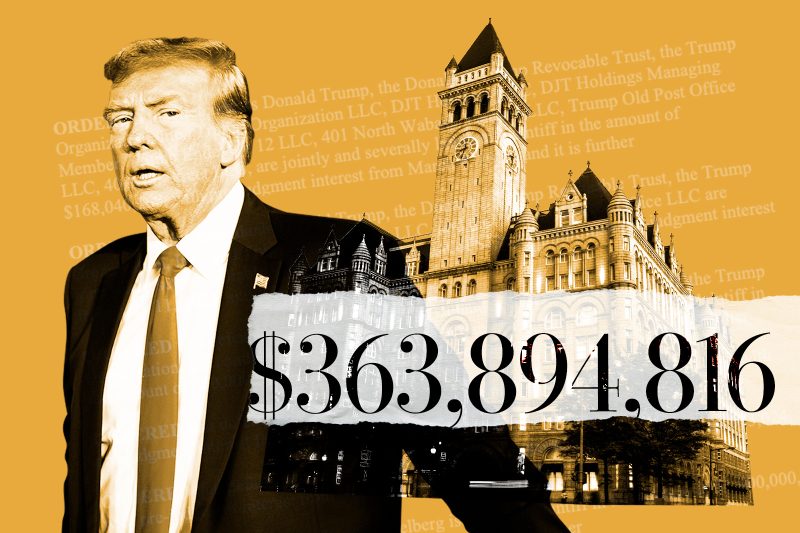

Justice Arthur Engoron’s ruling in the case came to $363,894,816 with the inclusion of $9,026,048 in penalties against Trump’s two adult sons and another company executive. Adding prejudgment interest brought the total for all defendants to more than $464 million.

Trump’s wealth has long been a subject of debate and those figures raised questions about his ability to pay the judgment. The Bloomberg Billionaires Index recently estimated his net worth at $3.1 billion, with $600 million in cash assets. Last year, Forbes put his total value at $2.5 billion.

New York Attorney General Letitia James’s lawsuit against Trump, the Trump Organization and the others said they produced false financial statements that were incorrect by as much as $2.2 billion a year from 2011 to 2021. According to the lawsuit, a deliberate procedure of providing inaccurate information enabled Trump, the company’s sole owner, to obtain better rates in loan negotiations and in insurance policy acquisitions.

Trump and his lawyers say they are appealing Engoron’s judgment.

Here’s how the judge’s numbers added up:

Engoron found that Trump benefited from ill-gotten gains in three major categories including the sale of the government lease for the former Trump International Hotel at the historic Old Post Office in Washington, sale of his rights to operate the Ferry Point golf course in New York City and interest savings that Trump obtained by portraying himself as less of a financial risk than he was.

For the Old Post Office, Engoron said Trump’s profits from the 2021 sale amounted to $126,828,600 and that the Trump family would not have gotten the lease and operational rights to that hotel, which hosted dignitaries and fundraisers during Trump’s presidency, had it not provided false information to the Government Services Administration in the bidding process. By presenting the federal agency with a steeply inflated picture of Trump’s finances, he unfairly obtained the lucrative contract ahead of other candidates, according to the New York attorney general.

Trump also owes $168,040,168 to cover savings he obtained in reduced interest rates by committing fraud, and he owes another $60 million in profits for the sale of the lease and management rights to the Ferry Point golf course in New York City, another contract that Engoron found the Trump Organization obtained through deception. Trump and the other defendants have been found liable of deliberately using inconsistent and misleading tactics — like tripling the size of Trump’s Fifth Avenue penthouse apartment to report an increased value — to magnify the overall financial worth to outside parties who relied on it to assess the terms of loans and other business deals.

Trump’s sons Eric and Donald Jr., who began running the Trump Organization when their father became president, each got $4,013,024 in proceeds from the Old Post Office sale. That is the amount the brothers now each owe in penalties, plus interest.

Allen Weisselberg, the only Trump company insider to go to jail for financial crimes (in a separate tax fraud case), owes $1 million, plus interest, representing the amount paid to him by Trump in a severance package. Engoron said that severance for Weisselberg, who worked for Trump family as an accounting employee and executive for a half-century, was obtained by committing illegal acts for his boss. Weisselberg was heavily involved in the composition of Trump’s annual financial statements, and authorities have said he played a key role in providing false property value data to the accountants who compiled Trump’s yearly report.

Trump owes about $100 million in prejudgment interest. As Trump and a team of attorneys and advisers scramble to sort out his options, his bill gets bigger. The attorney general’s office said Friday that Trump is accruing nearly $112,000 in post-judgment interest per day, up from an $87,500 daily prejudgment rate, and that the daily total for all the defendants is about $114,554.

This judgment is on top of the $88.3 million Trump already owed writer E. Jean Carroll stemming from a pair of jury verdicts that found him liable for defamation and sexual abuse. He is pursuing appeals in both Carroll cases.